|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Earnings Preview: What To Expect From Paychex's Report/Paychex%20Inc_%20office-by%20Eric%20Glenn%20via%20Shutterstock.jpg)

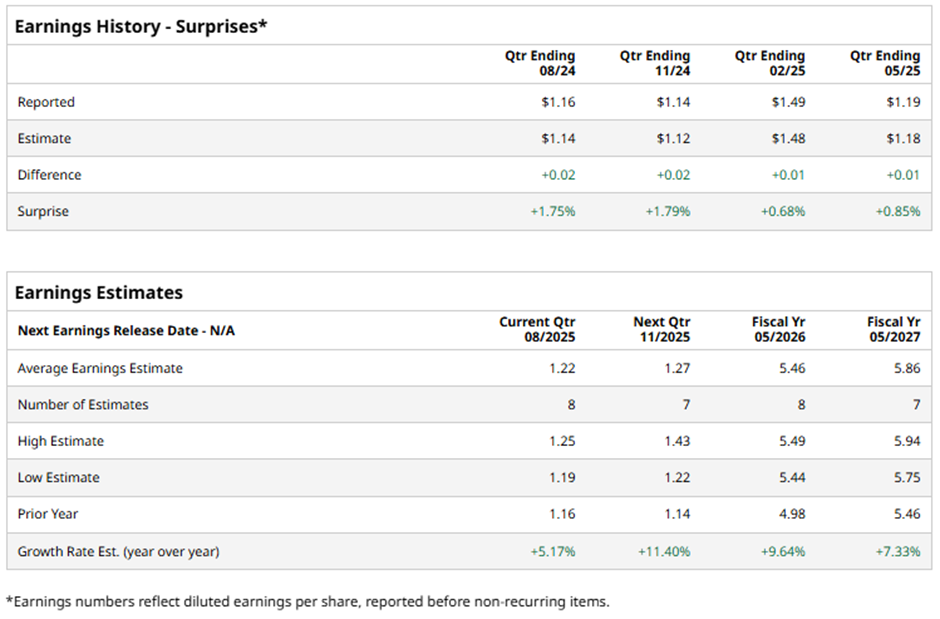

With a market cap of $52.7 billion, Paychex, Inc. (PAYX) is a leading provider of human capital management solutions, specializing in payroll, HR, benefits, and insurance services for small to medium-sized businesses. The company offers a comprehensive suite of customizable services to help businesses efficiently manage their workforce. Analysts project the Rochester, New York-based company to report an adjusted EPS of $1.22 in Q1 2026, a 5.2% growth from $1.16 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in the last four quarters. For fiscal 2026, analysts forecast the payroll processing services expert to report adjusted EPS of $5.46, up 9.6% from $4.98 in fiscal 2025.

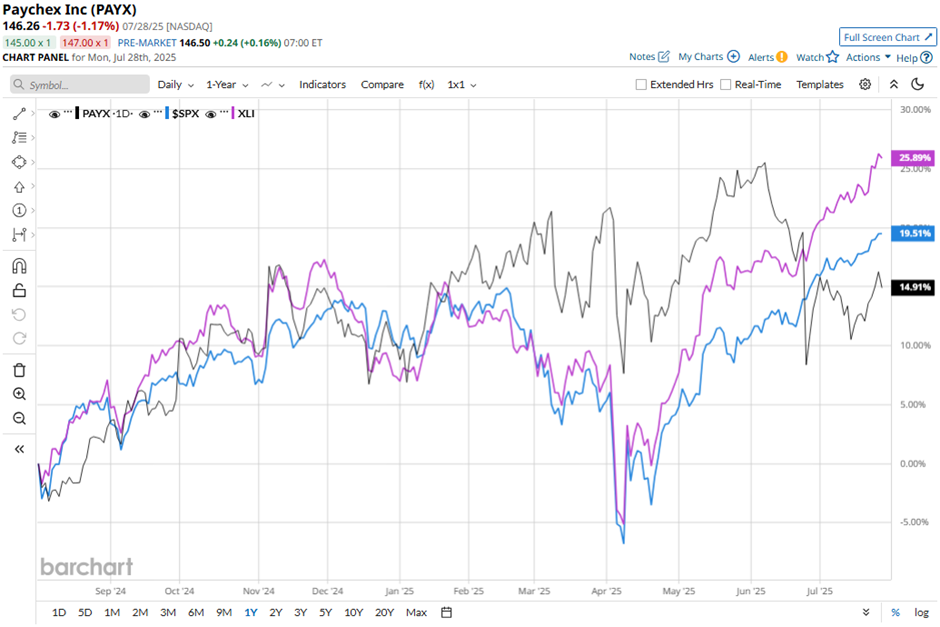

PAYX stock has increased 16.3% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 17.1% return and the Industrial Select Sector SPDR Fund's (XLI) 22.3% gain over the same period.

Despite Paychex beating Q4 2025 estimates with adjusted EPS of $1.19 and revenue of $1.4 billion, shares tumbled 9.4% on Jun. 25 due to a sharp 11% drop in operating income to $431.1 million and a 700-basis-point decline in operating margin to 30.2%, both missing expectations. Analysts' consensus view on Paychex stock is cautious, with a "Hold" rating overall. Among 16 analysts covering the stock, 14 suggest a "Hold" and two provide a "Strong Sell" rating. As of writing, the stock is trading below the average analyst price target of $151. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|