|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Worried About a Market Crash? Here Are 3 Stocks That ‘Big Short’ Star Michael Burry Loves Here./Lululemon%20Athletica%20inc_%20storefront%20by-%20Robert%20Way%20via%20iStock.jpg)

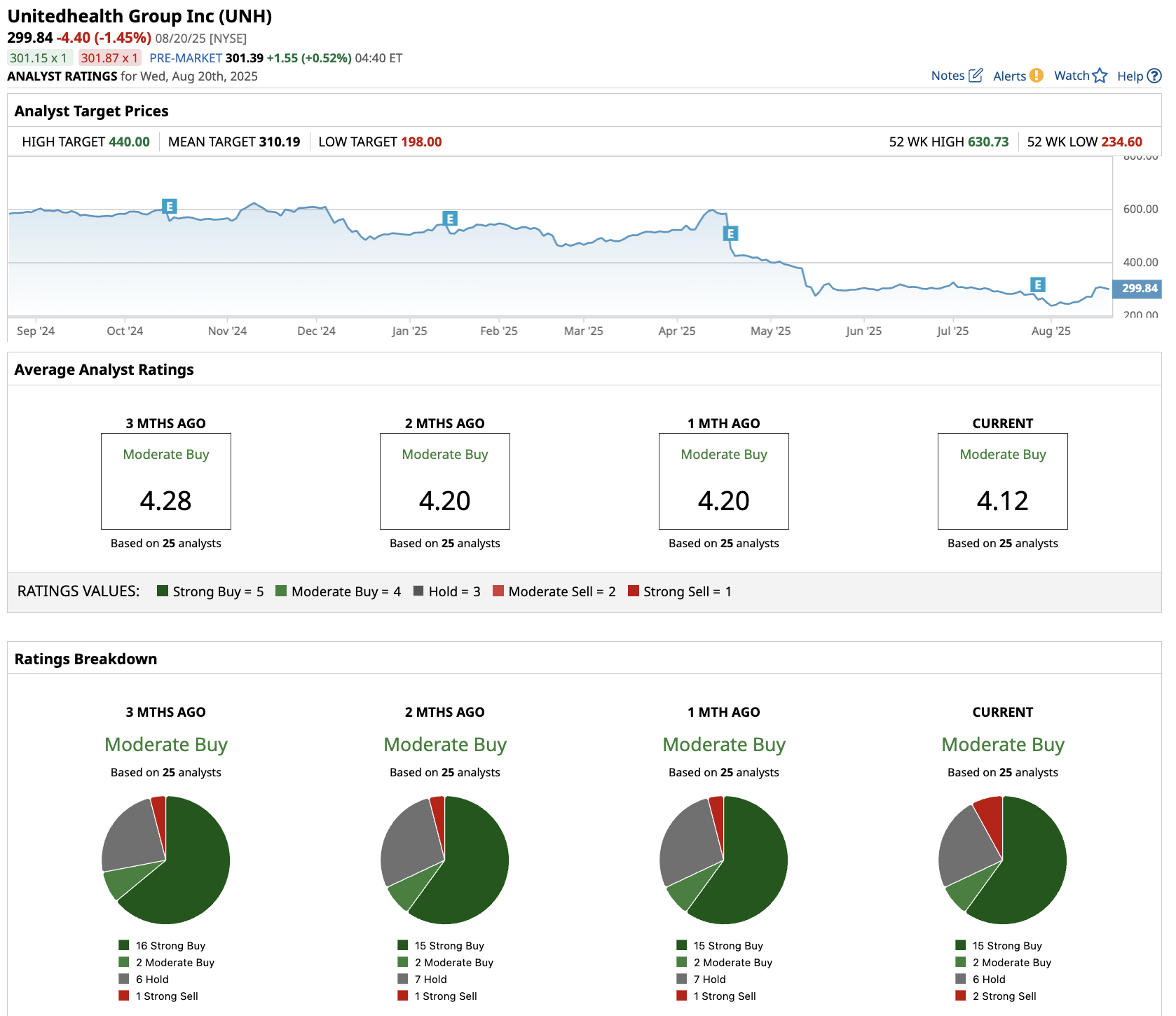

Michael Burry, the legendary investor who predicted the 2008 housing crisis and of "The Big Short" fame, has made notable changes to his portfolio that could offer insights for investors concerned about market volatility. His Scion Asset Management initiated new positions in three quality companies during Q2. These selections reflect Burry's apparent focus on established companies with strong fundamentals that can weather economic storms. Notably, Burry's Q2 moves represent a dramatic shift from his previous bearish stance. He swapped $186 million in bearish put options for $522 million in bullish call options, suggesting increased confidence in market stability. Here are three stocks Michael Burry added to his portfolio in Q2 of 2025. UnitedHealth (UNH) StockBurry acquired 20,000 shares of UnitedHealth (UNH), which is the nation's largest health insurer. Despite facing regulatory scrutiny and public criticism over healthcare costs, UnitedHealth's dominant market position and essential services make it a defensive play during economic uncertainty. UNH stock CEO Stephen Hemsley recently implemented sweeping changes across the organization, which include new leadership appointments and intensive monthly business reviews. UnitedHealth is also implementing dramatic repricing for 2026, with Medicare Advantage pricing assuming nearly 10% medical cost trends. This proactive approach, combined with benefit adjustments and network optimization, should restore margins to target ranges by 2027. The company's willingness to exit underperforming markets demonstrates disciplined capital allocation. Despite near-term pressures, OptumHealth's value-based care model continues delivering superior outcomes, with patients experiencing 20% fewer hospitalizations. Mature patient cohorts (2021 and prior) achieve 8%+ margins, proving the model's viability once execution improves. With $16 billion in expected operating cash flows and a 5% dividend increase, UnitedHealth maintains financial strength during this transition. Management expects "solid but moderate" earnings growth in 2026, accelerating in 2027 as reforms take hold. UnitedHealth's dominant market position across healthcare segments provides defensive moats while the company executes its turnaround strategy, making it an attractive contrarian investment opportunity. Out of the 25 analysts covering UNH stock, 15 recommend “Strong Buy,” two recommend “Moderate Buy,” six recommend “Hold,” and two recommend “Strong Sell.” The average UNH stock price target is $310, above the current price of $300.

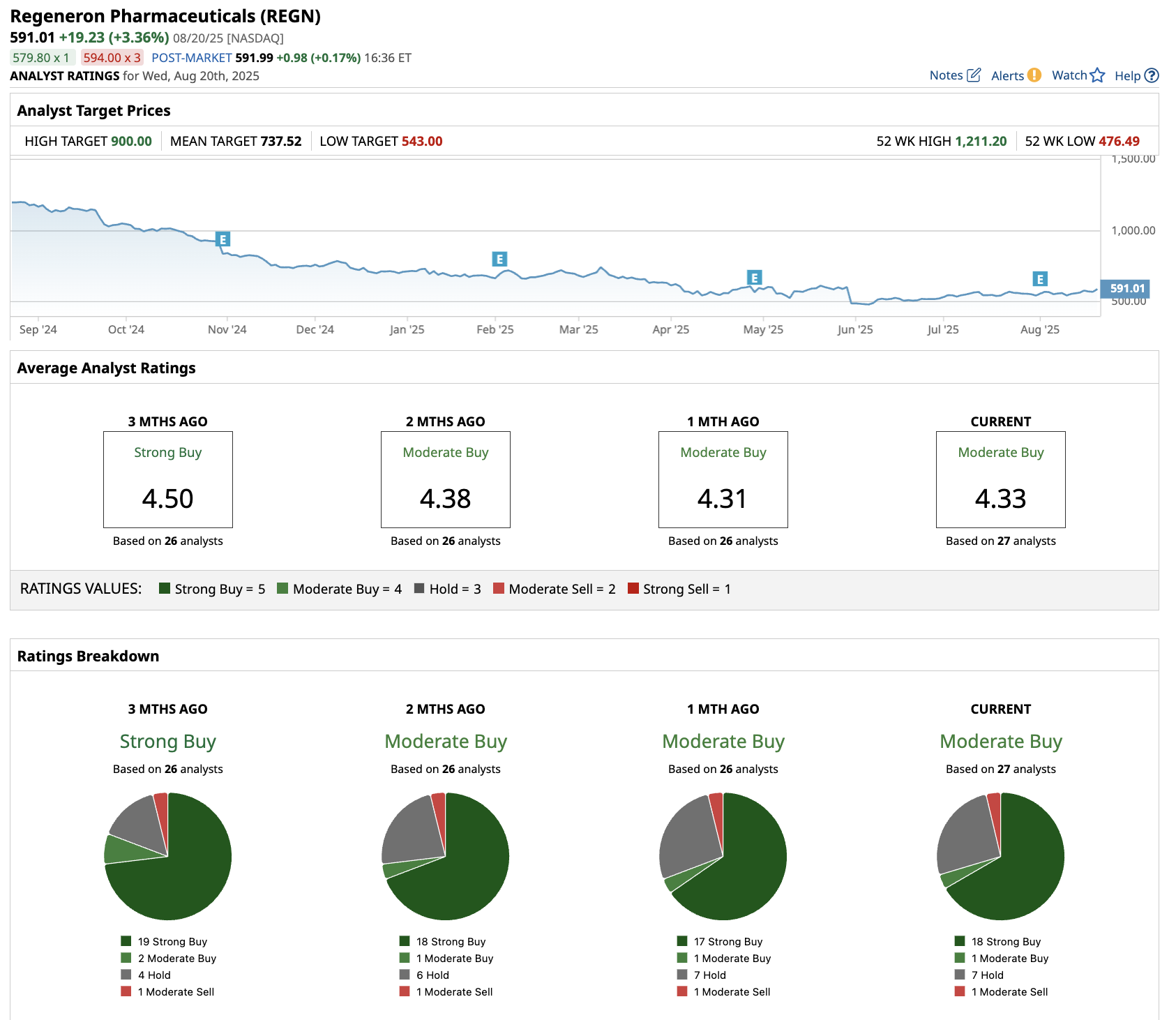

Regeneron Pharmaceuticals (REGN) StockBurry’s fund purchased 15,000 shares of Regeneron Pharmaceuticals (REGN), a biotechnology company with a diverse portfolio. Regeneron's innovative drug pipeline and strong cash flows provide stability during market downturns, while healthcare remains a recession-resistant sector. In Q2 of 2025, Regeneron delivered a strong financial performance driven by its blockbuster franchises. Dupixent achieved a remarkable 21% global growth on a constant currency basis, reaching $4.3 billion in quarterly sales and now annualizing at over $17 billion. With eight FDA-approved indications and a total addressable market exceeding four million patients in the U.S. alone, Dupixent has substantial runway for continued expansion. Recent approvals in COPD, chronic spontaneous urticaria, and bullous pemphigoid add over 600,000 biologic-eligible patients to its opportunity. EYLEA HD showed impressive momentum with 29% growth and $393 million in quarterly sales, while Libtayo delivered 25% constant currency growth. The recent FDA approval of Lynozyfic for relapsed/refractory multiple myeloma marks Regeneron's entry into the lucrative hematology market, with management planning up to 10 registrational trials across the $30 billion myeloma treatment landscape. Regeneron's approximately 45-product pipeline spans multiple high-value therapeutic areas, including thrombosis, obesity, genetic medicines, and oncology. With $17.5 billion in cash and strong free cash flow generation, the company maintains financial flexibility while investing heavily in R&D and returning capital to shareholders through meaningful share repurchases and dividends. Out of the 27 analysts covering REGN stock, 18 recommend “Strong Buy”, one recommends “Moderate Buy”, seven recommend “Hold”, and one recommends “Moderate Sell”. The average REGN stock price target is $738, above the current price of $591.

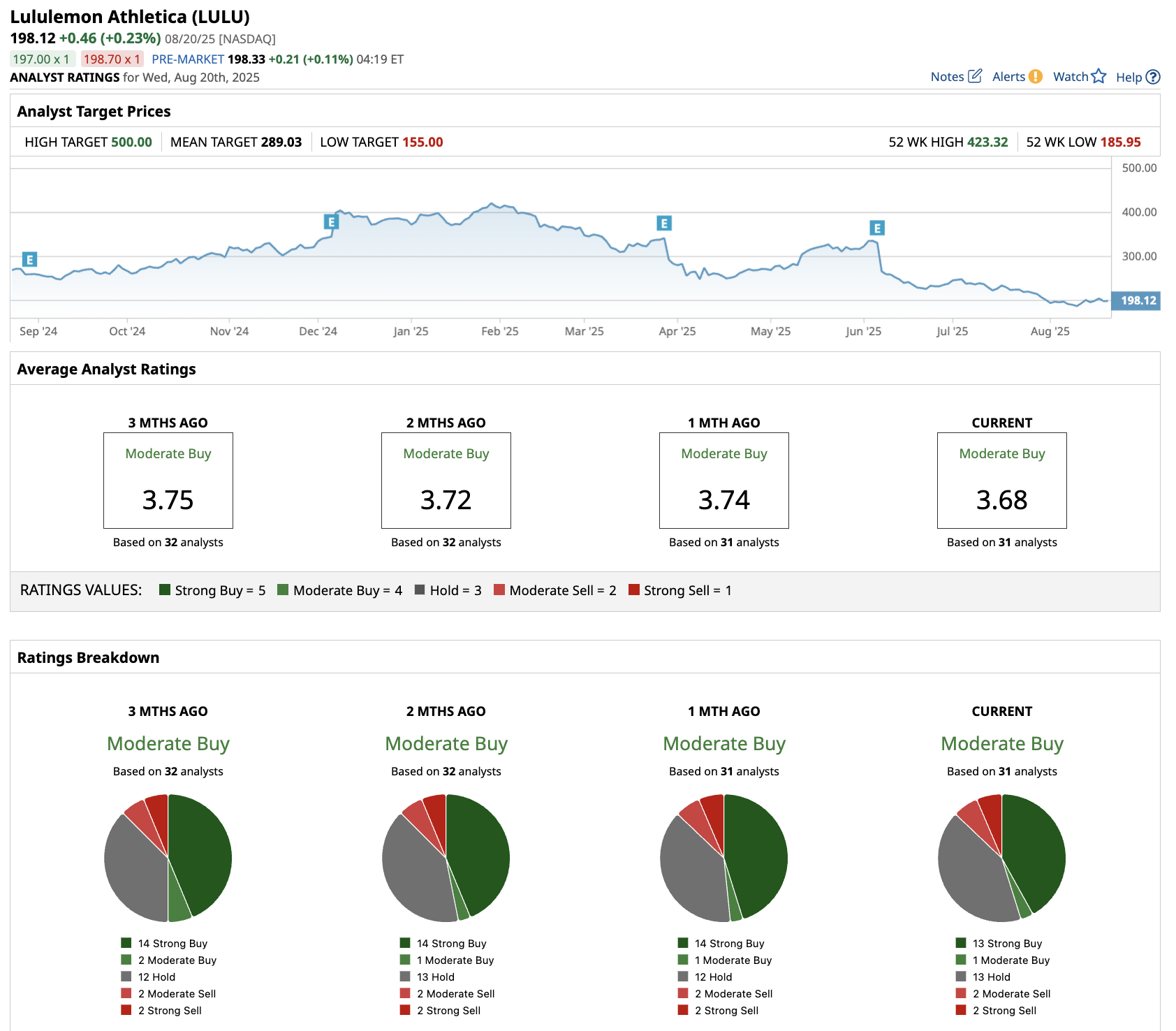

Lululemon Athletica (LULU) StockBurry also added 50,000 shares of the athletic apparel retailer in Q2. Despite recent struggles, Lululemon's (LULU) premium brand positioning and loyal customer base could position it for a comeback as consumer spending normalizes. In fiscal Q2 of 2025, Lululemon reported revenue of $2.4 billion, an increase of 7% year-over-year. While sales in the China Mainland rose 22%, Rest of World expanded by 17%. With $1.3 billion in cash, no debt, and industry-leading operating margins, Lululemon possesses the flexibility to invest in growth while managing external pressures like tariffs. Management maintained full-year revenue guidance of $11.15-11.3 billion, reflecting confidence in its underlying business momentum. International expansion remains a key growth driver, as Lululemon targets a 50-50 domestic-international revenue split over time. Currently at 25% international, this geographic diversification reduces dependence on any single market while capitalizing on global athleisure trends. Out of the 31 analysts covering LULU stock, 13 recommend “Strong Buy,” one recommends “Moderate Buy,” 13 recommend “Hold,” two recommend “Moderate Sell,” and two recommend “Strong Sell.” The average LULU stock price target is $289, above the current price of $198.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|