|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

3 Catalysts That Could Send Amazon Stock Soaring Soon/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

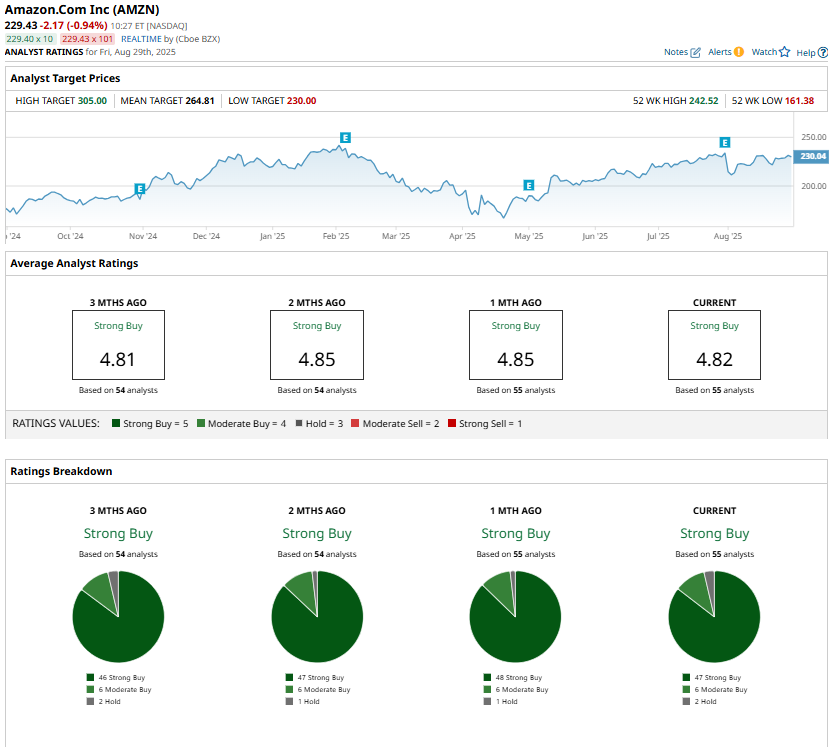

Amazon (AMZN) stock has underperformed the broader markets so far in 2025. Shares of the tech giant are up just 4.2% year-to-date, trailing well behind the S&P 500 Index’s ($SPX) 9.8% gain over the same period. While AMZN hasn’t delivered much upside yet in 2025, this lull may not last much longer. In fact, there are three key growth drivers that could drive Amazon stock higher. Let’s break it down.  #1. AWS Remains Amazon’s Growth PowerhouseAmazon Web Services (AWS), the company’s cloud division, remains its primary growth engine. In the most recent quarter, AWS generated $30.9 billion in revenue, representing 17.5% year-over-year growth. On an annualized basis, that puts AWS at a staggering $123 billion run rate, and this could further rise from current levels. Much of this momentum comes from rising demand across both generative AI and traditional cloud workloads. Businesses are adopting AI-driven tools and accelerating migration from on-premise infrastructure to the cloud. As companies invest in modernizing their operations and leveraging the benefits of generative AI, AWS is well-positioned to capitalize on this digital transformation. Amazon’s management points out that the majority of global IT spending is still tied to on-premises systems. Over the next decade, however, this balance is expected to reverse, with cloud adoption taking the lead. AWS has the advantage of scale, a wide array of features, and robust security. These strengths, combined with the accelerating push toward AI, suggest that AWS will continue to be one of Amazon’s most powerful catalysts for years to come. #2. Advertising Is Emerging as a Major Revenue EngineAmazon’s advertising segment is becoming one of the company’s most powerful growth catalysts. In the second quarter, ad revenue hit $15.7 billion, marking a 22% year-over-year increase. This growth reflects the strength of Amazon’s diverse ad ecosystem, which spans its e-commerce marketplace, Prime Video, Twitch, Fire TV, and live sports partnerships with big leagues. A key growth lever is the Amazon Demand-Side Platform (DSP). The platform’s precision targeting and secure data environments set it apart in a crowded digital ad market, supporting its growth. Further, Amazon’s recent partnerships will amplify its growth. A new Roku (ROKU) deal unlocks access to 80 million connected TV households, while an integration with Disney’s (DIS) ad exchange brings premium inventory from Disney+, ESPN, and Hulu. Together, these moves strengthen Amazon’s position as a must-have partner for advertisers and will support its long-term growth. #3. Amazon’s Profitability Is Heading in the Right DirectionAmazon’s improving profitability is another growth catalyst for the stock. In its latest quarter, the company delivered solid improvements across its North American and international operations, reflecting a more efficient and disciplined business model. North America reported operating income of $7.5 billion, up $2.5 billion from a year earlier. That lifted the region’s operating margin to 7.5%, a meaningful 190-basis-point expansion. The international business, which has historically lagged in profitability, is also showing momentum. Operating income surged to $1.5 billion, up $1.2 billion year-over-year, with margins improving to 4.1%, an impressive 320-basis-point increase. Amazon has been optimizing its vast transportation network. By positioning goods closer to customers and leveraging both first-party and third-party sellers, Amazon has achieved faster delivery speeds at lower costs. By holding items closer to demand, Amazon shortens delivery routes, reduces packaging needs, and cuts costs. Amazon is investing heavily in robotics and automation to further streamline its fulfillment process. Taken together, these operational efficiencies, technology investments, and advertising gains position Amazon to deliver solid profitability in the long run. The Bottom Line on Amazon StockWhile Amazon stock has lagged the broader market so far in 2025, the company’s underlying business remains strong. With its cloud and advertising business growing at a solid pace and operational efficiencies boosting margins, Amazon stock is set to soar higher. Wall Street is bullish and maintains a "Strong Buy" consensus rating on AMZN stock.  On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|