|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

3 Stocks to Buy Now for a New Era of Taylor Swift

Taylor Swift isn’t just breaking records—she's reshaping the business of music. From selling out stadium tours to driving streaming platforms to all-time highs, Swift has become one of the most powerful forces in the global entertainment industry. With Swift’s recent announcement of her newest album, The Life of a Showgirl, and the ongoing buzz surrounding her engagement to NFL star Travis Kelce, interest in the superstar has never been stronger. And in the world of investing, that kind of cultural dominance creates ripple effects far beyond the music charts. Wall Street has started to take notice. Companies tied to the music business—whether through streaming, live events, or royalties—stand to benefit directly from growing interest in Swift. Her influence translates into more streams, more ticket sales, more merchandise, and more cultural relevance, all of which flow into the financial results of the platforms and promoters behind the music. Three companies in particular stand to benefit from what could be called a “new era of Taylor Swift”: Spotify (SPOT), Live Nation Entertainment (LYV), and Universal Music Group (UMGNF). Each has a unique exposure to Swift’s music, brand power, and fan engagement. With that, let’s take a closer look at these stocks. Spotify (SPOT)Valued at a market cap of $140.3 billion, Spotify is a Stockholm-based digital streaming platform that provides users with access to a broad range of music, podcasts, and audiobooks. The company pioneered the “freemium” model, offering a free version with ads and no skips, alongside a paid premium version that removes ads and other limitations. It is well-known for revolutionizing the music industry by transitioning from a transaction-based model to an access-based one, enabling users to stream music on demand. Shares of the music and podcast streaming platform have rallied 52.4% on a year-to-date (YTD) basis. And this comes after the stock has already more than doubled in 2024. These staggering gains came after the company cut costs, became profitable, and began showing margin expansion, following a period when it was criticized as a cash-burning media firm with questionable unit economics.

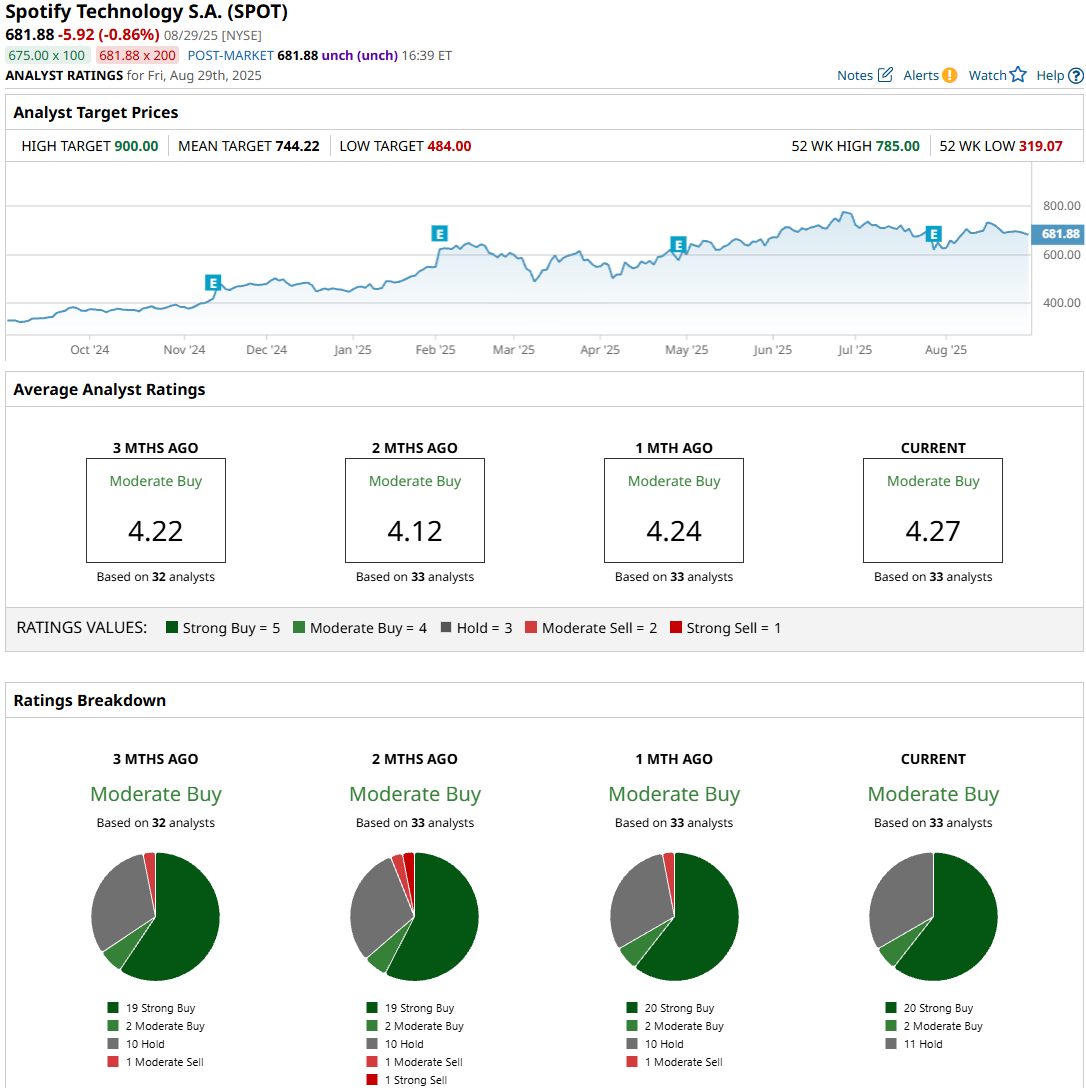

It’s also worth mentioning that this outperformance pushed the company’s valuation to unprecedented levels. SPOT’s forward EV/EBITDA ratio stands at 53.42, more than five times the sector median, leaving little room for error. Swift’s new album is set to boost Spotify, as all those Swifties will be streaming her music on the platform. Swift has around 84 million listeners on Spotify, where she has exceeded 100 billion streams. In December of last year, Spotify reported that Swift’s catalog had generated over 26 billion streams in 2024, making her the most-streamed artist on the platform for the second consecutive year. Morningstar analyst Matthew Dolgin stated that Swift’s new album could help boost Spotify’s upcoming “Superfan Tier,” a higher-priced premium offering for devoted music fans, featuring exclusive benefits like early ticket access. Spotify released its latest quarterly report on July 29, sending the stock down over 11% after it missed both revenue and earnings expectations and issued a weak forecast for the current quarter. The company unexpectedly swung to a loss of 42 euro cents per share due to higher-than-expected expenses for employee compensation, while its revenue rose approximately 10% year-over-year (YoY) to 4.19 billion euros. Still, the company’s growth in Premium subscribers and monthly active users (MAUs) both exceeded expectations, with net additions of 8 million and 18 million, respectively, during the quarter. With that, Spotify’s member engine continued to gain ground in Q2, which bodes well for its long-term outlook. For Q3, management forecasts 710 million MAUs, 281 million Premium subscribers, and total revenue of 4.2 billion euros. Analysts tracking the company project a 13.97% YoY increase in its EPS to $6.51 for fiscal 2025, with revenue expected to grow 23.35% from the prior year to $20.08 billion. Most Wall Street analysts see further upside for SPOT, giving the stock a consensus rating of “Moderate Buy.” Among the 33 analysts offering recommendations for the stock, 20 rate it as a “Strong Buy,” two advise a “Moderate Buy,” and the remaining 11 recommend holding. The average price target for SPOT stock stands at $744.22, representing a 9.1% upside from Friday’s closing price.

Live Nation Entertainment (LYV)Live Nation Entertainment is a global leader in the live entertainment industry. The company generates revenue by organizing and producing live music events at venues it owns, operates, or rents, selling tickets through mobile apps and its Ticketmaster subsidiary, and securing sponsorships and advertising that enable businesses to connect with audiences at its live events. LYV’s market cap currently stands at $38.6 billion. Shares of the ticketing and live events company have climbed 28.6% YTD. LYV stock experienced considerable volatility earlier this year but has since trended upward, driven largely by strong demand for live entertainment, the company’s strategic initiatives, and positive market sentiment.

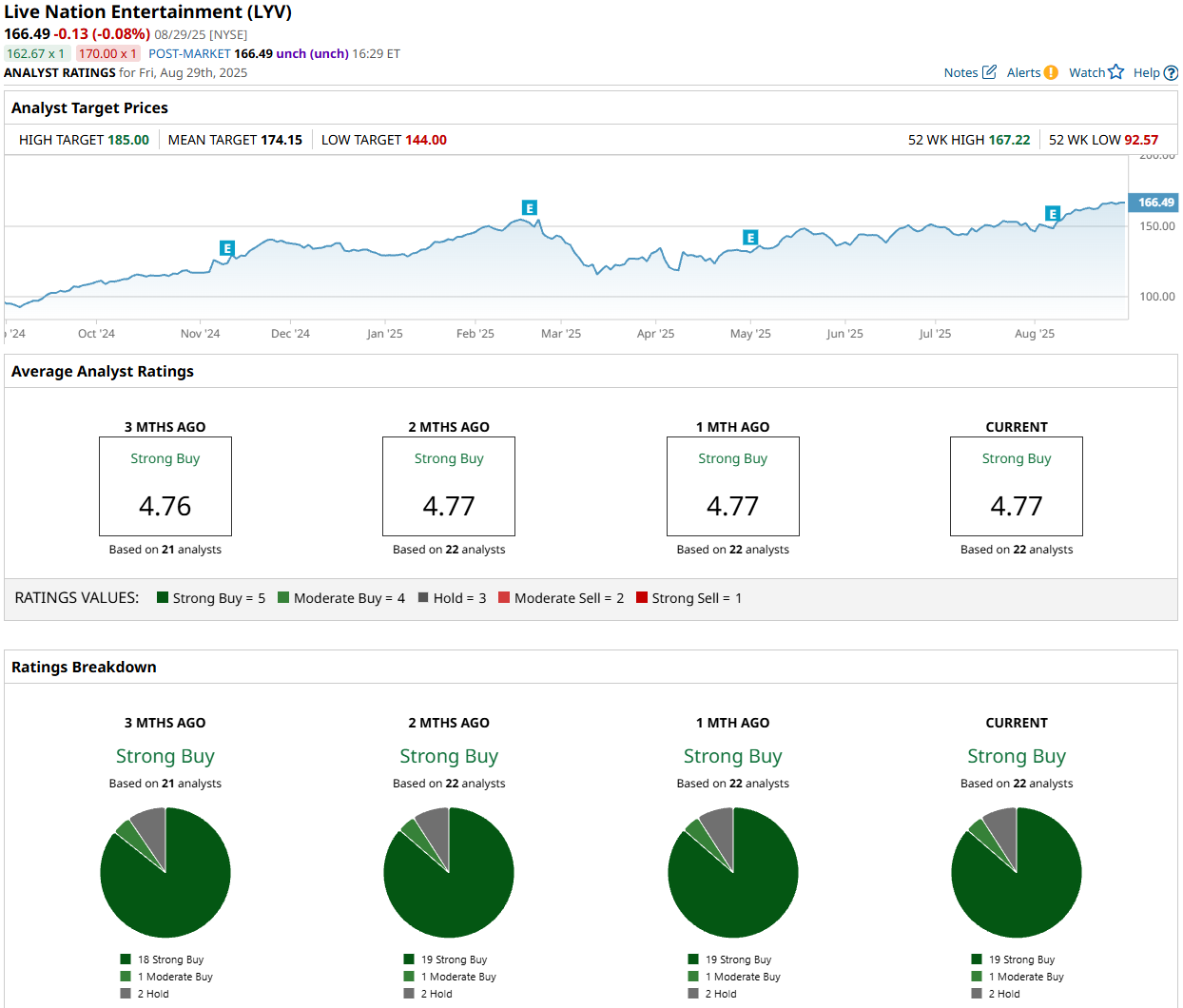

LYV stock is trading at 113.26 times forward adjusted earnings, surpassing even 2022 levels, when discretionary spending on leisure and entertainment surged in the post-Covid rebound. This lofty valuation could limit further upside and suggests investors may want to wait for a pullback, say, to the $150 level (where there is a Fair Value Gap (FVG)), before considering buying the stock. I think it’s clear how Live Nation Entertainment stands to benefit from Swift’s newest album. If Swift takes this album on tour, LYV could see a boost, as fans spend heavily to watch their favorite artist perform live. It could bolster multiple revenue streams, including Ticketmaster sales, VIP packages, and online fees. Live Nation Entertainment reported its second-quarter earnings results in early August. Its total revenue stood at $7 billion, up 16% YoY, driven mainly by its core Concerts business. Concert revenue climbed 19% YoY to a record $6 billion, fueled by a 14% increase in global attendance to 44 million fans. Total adjusted operating income (AOI) rose 11% YoY to $798 million, driven primarily by the Concerts segment, which delivered a record $359 million AOI in the quarter. Meanwhile, tickets sold for 2025 events have already jumped to over 130 million, up significantly from 95 million in the prior quarter, with this momentum reflected in deferred revenue—up 25% YoY to $5.1 billion for concerts and 22% YoY to $317 million for Ticketmaster. It’s impossible to overlook the company’s strong international growth, with concert attendance, Ticketmaster GTV, and sponsorship sales all rising by double digits. With that, the company’s key metrics are definitely moving in the right direction, supporting its long-term growth outlook. For fiscal 2025, analysts expect the company’s EPS to fall 41.90% YoY to $1.59, followed by a strong rebound to $3.12 the following year. At the same time, LYV’s revenue is expected to grow 12.12% YoY to $25.96 billion this year. Wall Street analysts have deemed LYV stock a “Strong Buy,” with an average target price of $174.15, indicating an upside potential of 4.6% from Friday’s closing price. Out of the 22 analysts covering the stock, 19 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and the remaining two give a “Hold” rating.

Universal Music Group (UMGNF)With a market cap of $51.8 billion, Universal Music Group is the world’s leading music entertainment company. Based in the Netherlands, the company is one of the “Big Three” record labels, alongside Sony Music Entertainment and Warner Music Group (WMG). It holds the rights to a continually expanding music catalog, including major contemporary stars such as Taylor Swift and Eminem. Shares of the music label have gained 10.1% YTD. The stock is supported by accelerating subscription trends and the company’s Streaming 2.0 strategy.

UMGNF stock trades at a forward EV/EBITDA multiple of 17.18, a more than reasonable valuation for a company with a solid moat, and more importantly, the multiple is roughly in line with Warner Music Group’s, which has slower growth. Universal Music Group stands to benefit from new music by Swift as well. As Swift’s record company, UMGNF will earn a share of both streaming and publishing revenue from her new songs. Notably, Swift’s music generates between $40 million and $80 million in annual revenue for the company, according to Wolfe Research analysts. On July 31, Universal Music Group announced its financial results for Q2. Revenue grew 4.5% YoY in constant currency to 2.98 billion euros, driven by growth in the Recorded Music and Music Publishing segments. More precisely, Recorded Music revenue increased 3.9% YoY, while Music Publishing revenue grew 14.5% YoY. Subscription revenue rose 8.5% YoY in constant currency, the fourth straight quarter of high-single-digit growth, achieved even without the full impact of the Streaming 2.0 initiatives. At the same time, Merchandising revenue declined 12.7% YoY, though the drop was expected given the lighter release slate. On the profitability front, the picture remains strong, with adjusted EBITDA up 7.3% YoY in constant currency to 676 million euros. With that, the fundamentals have demonstrated solid momentum, strengthening confidence in Universal Music Group’s long-term growth trajectory. Analysts project Universal Music Group’s revenue to increase 11.33% YoY to $14.21 billion in FY25, although consensus profit estimates are not available. Also, UMGNF stock currently has no Wall Street coverage. On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|