|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Netflix’s (NFLX) Unusual Options Presents an Opportunity Before Its Volatility Skew Widens

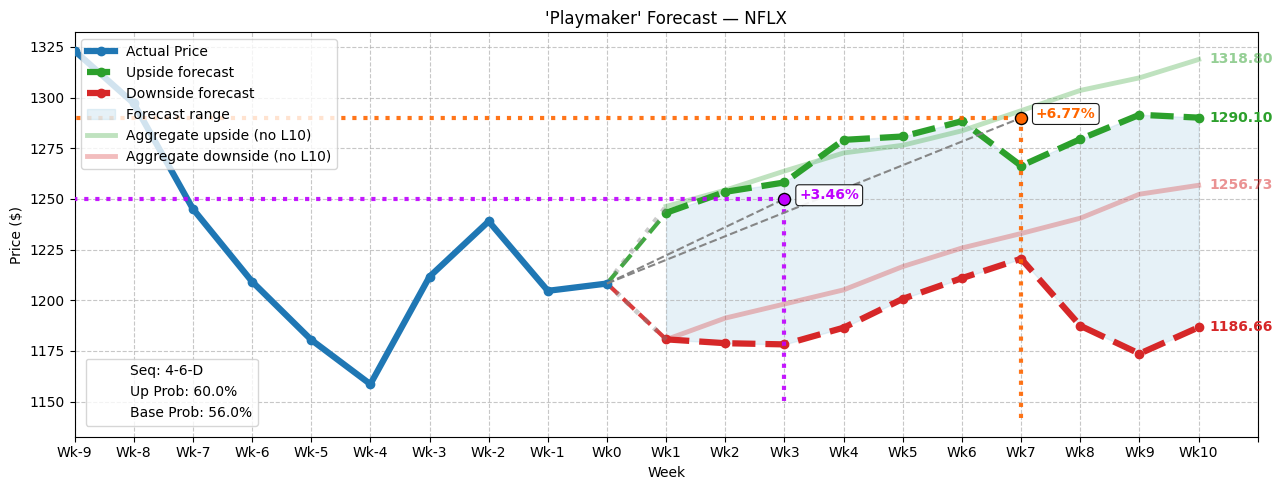

Sometimes, unusual options activity could give retail investors the wrong impression. Case in point is streaming giant Netflix (NFLX). On Friday, aberrant transactions in the derivatives arena implied brewing pessimism for NFLX stock. However, a deeper analysis reveals a contrarian opportunity instead — with a small caveat. Heading into the long weekend, total options volume reached 164,872 contracts, representing a 44.8% lift over the trailing one-month average. However, put volume was quite high at 76,931 contracts. While call volume stood at 87,941 contracts, the put/call ratio was only about 0.875. All other things being equal, you’d want to see a lower ratio, which may imply many more call options being bought than puts. However, the important nuance is that options can be bought or sold. To get a clearer picture, you should consult Barchart’s options flow screener, which focuses exclusively on big block transactions likely placed by institutional investors. Here, net trade sentiment slipped to nearly $4.3 million below parity, thus favoring the bears. Still, even this revelation deserves careful context. Among bearish trades, the biggest transaction by dollar volume was for $2.131 million worth of sold $1,200 Sept. 19 calls. With a bid price of $35.95, NFLX stock needs to stay below $1,235.95 at expiration to avoid assignment (assuming that these calls aren’t part of a credit leg of a multi-leg strategy). However, the amount of money at risk suggests that traders may be looking to trim their position in NFLX stock. Therefore, if assignment materializes, the traders exit at a price they’re comfortable with. If NFLX stays below the breakeven point, the credit sellers end up with the shares and some income to pad their portfolio. To be fair, Friday’s options data wasn’t a great look for NFLX stock. However, I would argue that it’s far from devastating — and may hide a contrarian opportunity. NFLX Stock Could be Flashing a Quick Discount for Intrepid TradersAlthough the unusual options print wasn’t overtly conducive for bullish traders, it has signaled a possible discount brewing in the streaming giant. Since Aug. 18, NFLX stock is down nearly 3%. No, it’s not a screaming deal. However, with shares up 79% in the past 52 weeks, traders are looking for viable opportunities to get back on the wagon. Plus, the more important point is that from the half-year mark, NFLX stock is down 10%. That’s sizable for such a powerhouse name — and it may be time to consider going contrarian. Using descriptive non-parametric (meaning no assumption of distribution such as normal, lognormal, Poisson, etc.) statistics under a modified Markovian state transitional framework, the natural or baseline skew of expected weekly prices projects an upper median pathway of $1,318.80 and a lower median pathway of $1,256.73 over the next 10 weeks. Essentially, this is the expected skew of results assuming no special mispricing — the null hypothesis if you will. However, NFLX stock has printed a distinct quantitative reversal signal. In the past 10 weeks, the market voted to buy shares four times and sell six times, leading to an overall downtrend during the period. For classification, this sequence can be labeled 4-6-D.  Using past analogs and applying the same non-parametric statistics under a modified Markovian framework, this conditional skew is calling for an upper median pathway of $1290.10 and a lower median pathway of $1186.66. However, the skew is projected to tilt negatively around the time of the Oct. 17 options expiration date. Further, the volatility range could expand significantly by the end of October and beginning of November, creating unpredictability and volatility risks. In football terms, the later weeks may end up like a goal line offense, with defenders bunched together in a confined space. It’s not an ideal trading environment. But before this bunching up happens, there may be an opportunity to throw the ball down the field, where the defense isn’t as densely packed. Two Trades to Put on Your RadarUsing the market intelligence above, there are two compelling bull call spreads to consider. This multi-leg strategy involves buying a call option and simultaneously selling a call at a higher strike price. The idea is to use the proceeds from the credit leg (short call) to partially offset the debit paid for the long call. This structure discounts the bullish position but with a capped-risk, capped-reward geometry. First, traders may consider the 1,242.50/1,250 bull spread expiring Sept. 19, which features a maximum payout of 150% if NFLX stock rises through the short strike price ($1,250) at expiration. For the trade to be fully profitable, NFLX will need to rise 3.46% from Friday’s close over the next three weeks. This seems like a doable target based on both the natural and conditional skew. Second, traders who want more time cushion may consider the 1280/1290 bull spread expiring Oct. 17. This trade carries a maximum payout of nearly 160%, though the net debit required is higher ($385 versus $300). Moreover, you may be required to pull out early from the spread because the positive skew may tilt negatively at that point. On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|