|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Corn, Soybean, Wheat, Cotton: Let’s Break Down What You Need to Be Watching This Week

Here is a two-minute markets analysis and outlook for the grain and cotton futures markets. Let’s go! Corn Bulls Show ResilienceDecember corn (ZCZ25) futures last hit a four-week high last Friday and for the week gained 8 3/4 cents. It was a good finish to the week for corn, after the market was under selling pressure earlier in the week. Heavy short covering and perceived bargain hunting were featured late last week. December corn also scored technically bullish weekly and monthly high closes last Friday, which set the market up for follow-through chart-based buying this week. The next upside price objective for the confident corn bulls is closing prices above solid technical resistance at $4.35, which would then open the door to a move to the $4.50 area, basis December futures. Below-normal rainfall and temperatures are expected in the U.S. Corn Belt over the next week to 10 days. Most of the U.S. corn crop is out of danger for dry weather and the only concern over the next couple weeks could be some scattered frost in some northern Corn Belt states.

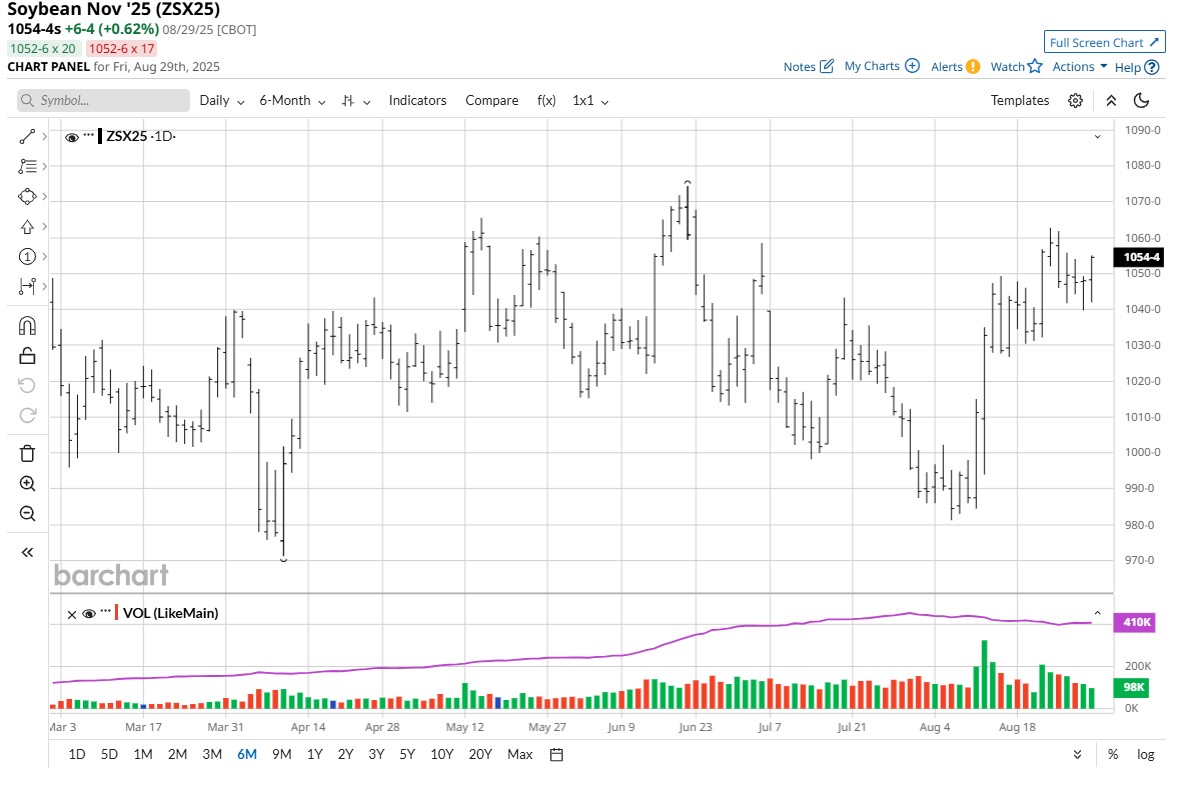

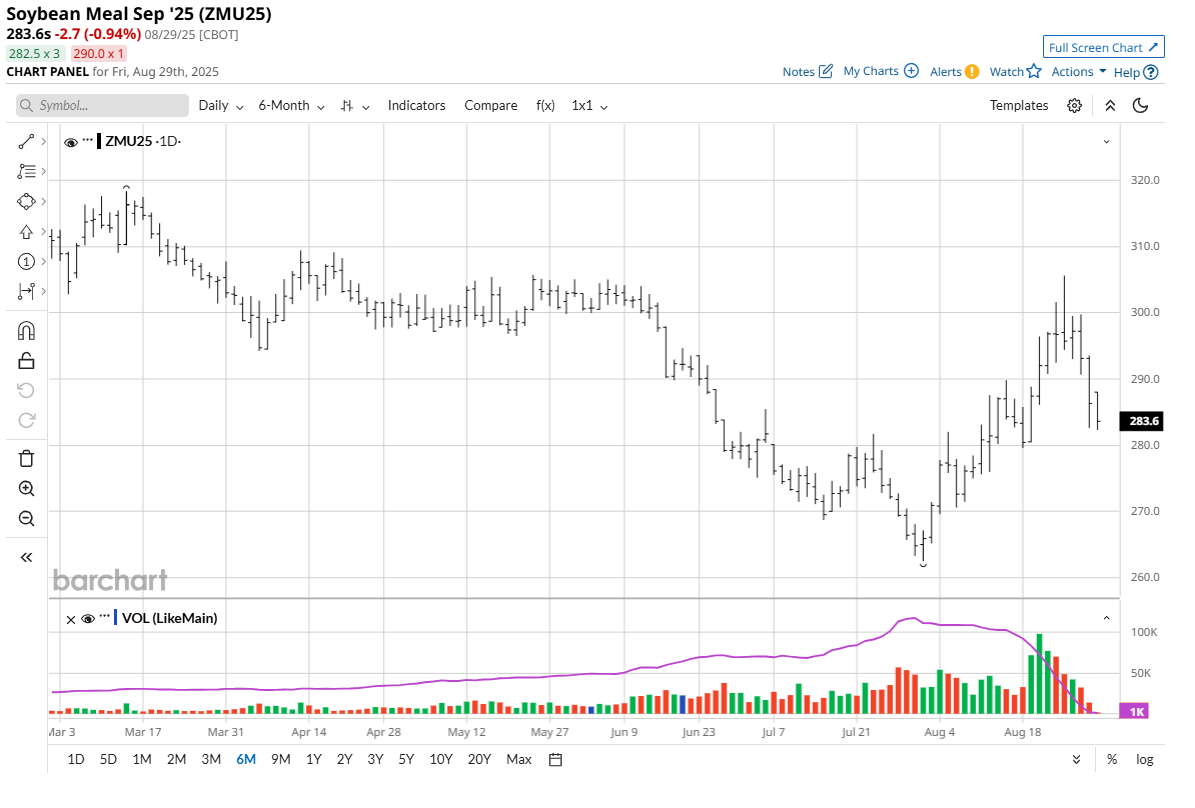

Demand for Corn Has Been SolidCurrent U.S. corn prices, which are still by no means elevated by historical standards, continue to garner strong demand, both domestically and in the export market. This comes even though the marketplace expects a record U.S. corn crop yield. However, corn traders could still have in the back of their minds the Pro Farmer Crop Tour in late August that indicated the crop may not finish in fine form. Commercial Hedge Selling Pressure ComingU.S. corn harvesting will be in full swing by mid-October, which suggests increased commercial hedging pressure as corn comes from the field into the local elevators. That could limit the price upside for the corn futures market until harvest starts to wind down in November. Corn traders will continue to monitor progress on new trade deals between the U.S. and its major trading counterparts, including and especially China. Soybean Bulls Make Some Progress, But Meal Is a WorryThe soybean (ZSX25) futures market got some traction last Friday from solid gains in corn and some short covering in winter wheat futures. However, the slumping soybean meal (ZMU25) futures market has the bean market bulls worried. September soybean meal futures hit a two-week low last Friday and on the week lost $13.10 a ton. Meal will have to show price strength soon if the soybean bulls want to keep the present price uptrend on the daily chart alive. If soybean bulls can push and close prices above solid chart resistance at the June high of $10.74 1/4, they would gain power strength to suggest a challenge of $11.00 a bushel.

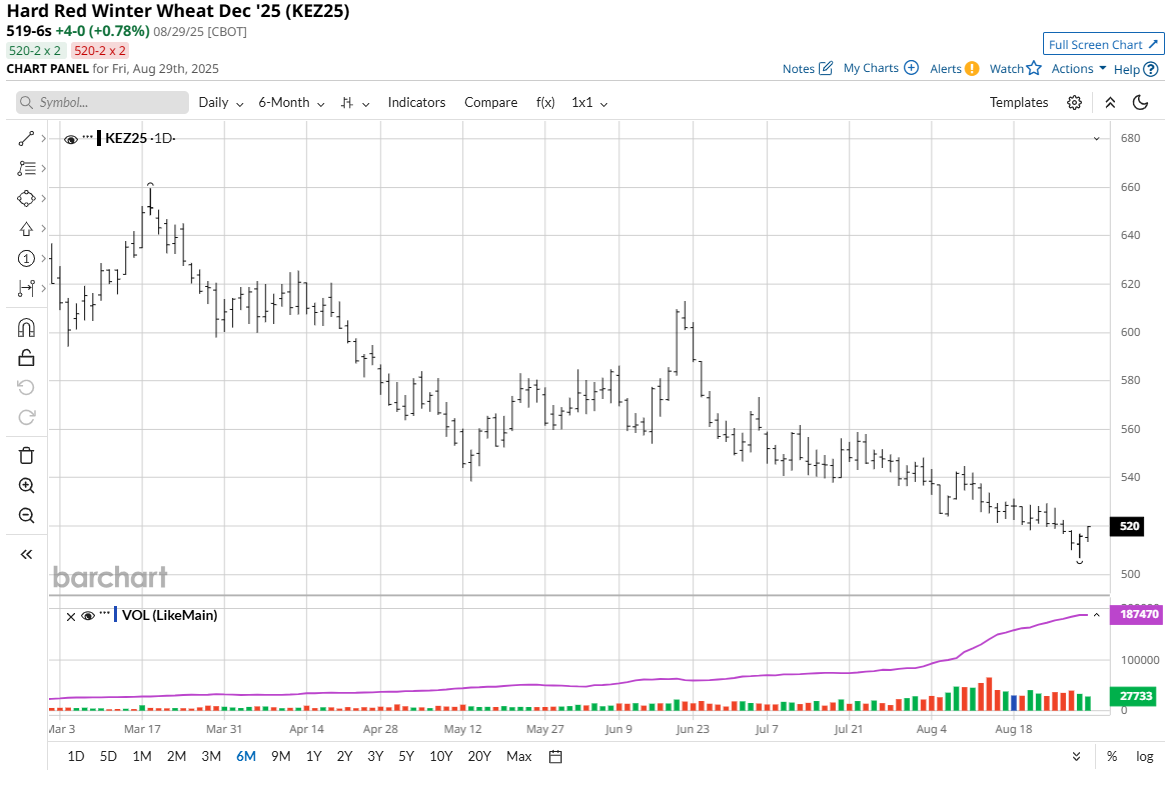

Weather Leans a Bit Price-Friendly for SoybeansMidwestern areas from southeastern Missouri to southern Illinois will were mostly dry early this week. Stress to the soybean crops in these regions could produce declines in soybean yields. However, cooler temperatures during the next week will reduce crop stress and at least some rain the region at mid-week could improve soil moisture. However, the rain could come too late to help the soybean crops produce bigger yields. U.S. Soybean Harvest Moves into High Gear This MonthU.S. soybean harvesting will pick up this month and that means more commercial hedge selling pressure as farmers gather their crops and unload them at the local elevators. However, hedge pressure may be less intense in the coming months as producers look to store their crop if cash basis levels remain weak. Early yield reports from the fields will likely influence soybean futures prices, especially after the Pro Farmer Crop Tour in late August revealed what may be a less-than-ideal finish for the soybean crop. China Is a Wild CardAll soybean trader eyes will remain on China in the coming months as the top global soybean importer continues to stall on U.S. new-crop purchases. This situation has significantly widened soybean cash basis levels, with increasingly low river levels adding insult to injury. Winter Wheat Markets Seemingly Can’t Get Out of Their Own WayDecember soft red winter (ZWZ25) and hard red winter wheat (KEZ25) futures saw short covering featured last Friday. The technically bullish weekly high close in December SRW wheat last Friday may encourage some follow-through buying from the speculators this week. However, both markets remain mired in price downtrends on the daily bar charts that continues to invite the speculators to the short sides of the markets. It’s going to take a close in December SRW wheat above technical resistance at $5.60 a bushel to energize the wheat bulls and suggest near-term price bottoms are in place.

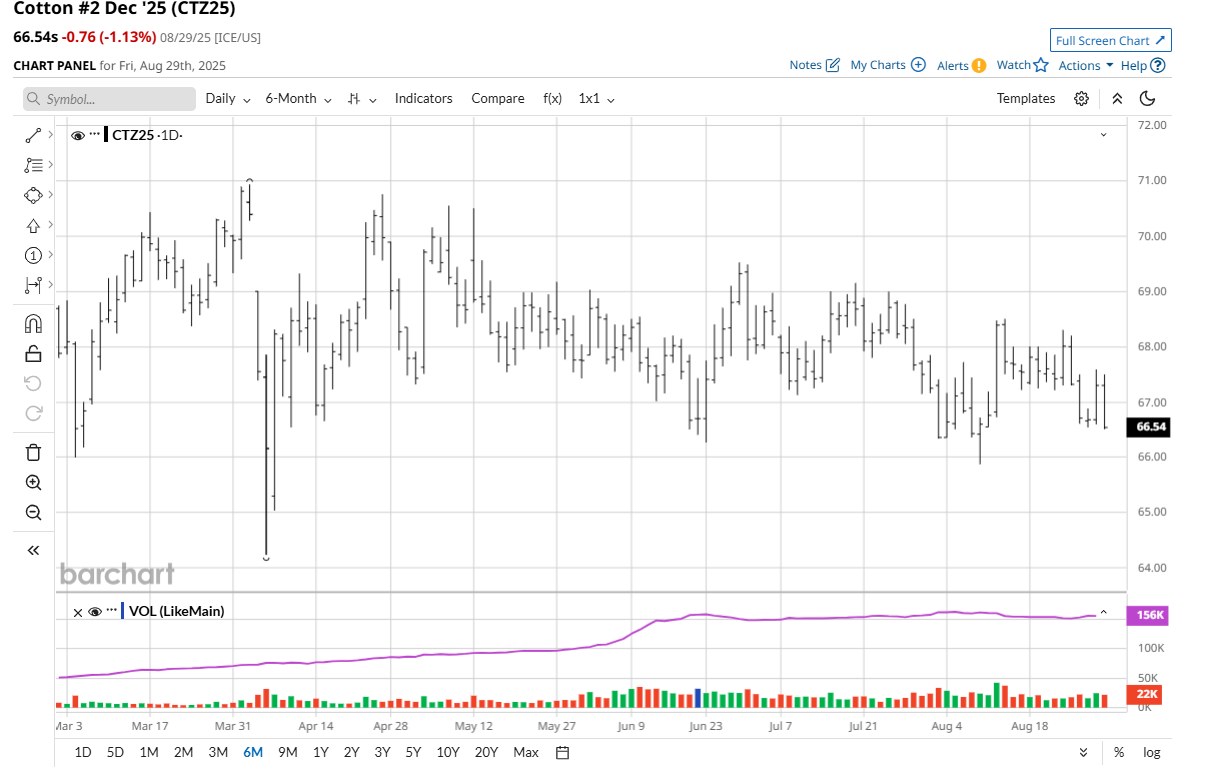

Weather is U.S. wheat country is mostly benign. In the Northern Plains, some rain is expected next week. Conditions will be good for field work and harvesting. Some frost is possible in central and eastern production areas at mid- to late-week. Less Commercial Hedge Pressure Is Price-PositiveOn the bullish side, the coming weeks are likely to see less commercial hedge selling pressure in the wheat futures markets. The U.S. HRW crop harvest is virtually complete. Spring wheat harvest progressed to over half complete as of Aug. 24, per the USDA, which is slightly behind last year. Barring a significant wheat futures market rally in the coming months, 2025-26 U.S. wheat planted acres could be significantly reduced compared to this year. Fall plantings may decline due to the current lower prices. However, improved export demand for U.S. wheat could boost futures prices in the coming weeks. Cotton Futures Languish in a Sideways, Choppy Trading RangeDecember cotton (KGZ25) futures last week lost 147 points, to close at 66.54 cents. Last Friday’s technically bearish weekly low close in December cotton sets the stage for follow-through selling interest from the chart-based speculators this week. It’s going to take a push in December cotton futures above chart resistance at the August high of 68.50 cents to get the bulls fired up enough to attempt to sustain a near-term price uptrend. Conversely, a drop in December cotton prices below strong technical support at the August low of 65.88 cents would trigger still-stronger selling pressure. This afternoon’s weekly USDA crop progress data will be closely scrutinized by cotton traders.

Southwest Texas Cotton Needs RainDryland cotton in southwestern west Texas needs a good shot of moisture, but there are no solid prospects in the forecast, as of this writing. Other areas in west Texas were forecast to get rain, with some significant amounts in the north and central parts of the region. Temperatures will be cooler than usual during the next seven days, which will conserve soil moisture. U.S. Delta crops have dried out, resulting in some cotton crop stress. The southeastern U.S. states should continue to see a good mix of rain and sunshine. Buckle Up: September and October Can Be TurbulentVeteran market watchers also know that history shows September and October can be extra turbulent trading months for the stock and financial markets. Any stock market gyrations in the coming weeks will almost certainly have an impact on the cotton futures market. Also, the FOMC meeting on Sept. 16-17 is highly anticipated because the Federal Reserve is expected to lower U.S. interest rates by 0.25%, with an outside chance the central bank might do a 0.5% rate cut. The easier Fed monetary policy this fall should be a bullish macro element for the cotton market. The progress, or lack thereof, on U.S. trade deals with its major counterparts will also likely influence the cotton market this fall, especially the ongoing trade discussions between the U.S. and China. China is a major cotton importer. Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com. On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|