|

||||||||||||||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Extra Space Storage Stock Underperforming the Dow?

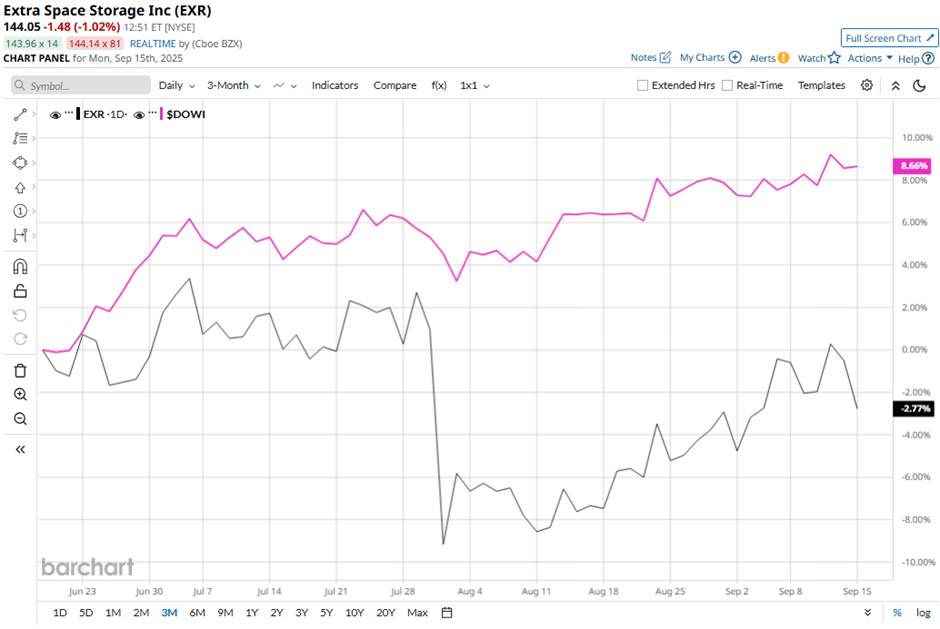

With a market cap of $31.2 billion, Extra Space Storage Inc. (EXR) is a leading self-storage real estate investment trust (REIT). As of June 30, 2025, the company owned and/or operated 4,179 stores across 43 states and Washington, D.C., comprising approximately 2.9 million units and 321.5 million square feet of rentable space. Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Extra Space Storage fits this criterion perfectly. Recognized as the largest operator of self-storage properties in the United States, Extra Space offers secure and convenient storage solutions, including options for boats, RVs, and businesses. Shares of the Salt Lake City, Utah-based company have declined 22.1% from its 52-week high of $184.87. Over the past three months, its shares have decreased 3.8%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 8.6% rise during the same period.  Longer term, EXR stock is down 3.8% on a YTD basis, lagging behind DOWI's 7.7% gain. Moreover, shares of the company have dipped 19.1% over the past 52 weeks, compared to DOWI’s 10.7% increase over the same time frame. The stock has been in a bearish trend, consistently trading below its 200-day moving average since mid-December last year.  Shares of Extra Space Storage tumbled over 10% after Q2 2025 results on Jul. 30 as core FFO per share came in at $2.05, missing the consensus estimate. Same-store NOI dropped 3.1% to $474.2 million as expenses surged 8.6% to $191.4 million, while interest expenses climbed 6.6% to $146.1 million, pressuring margins despite a 60-basis-point occupancy gain to 94.6%. Adding to investor concerns, management revised 2025 guidance to a narrower FFO of $8.05 per share - $8.25 per share range with expectations of flat-to-negative same-store revenue growth and NOI decline. However, rival Lineage, Inc. (LINE) has performed weaker than EXR stock. LINE stock has dipped 27.9% YTD and 49.2% over the past 52 weeks. Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 22 analysts in coverage, and the mean price target of $157.63 is a premium of 9.4% to current levels. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|